Imagine a country where public funds are allocated arbitrarily rather than because of an analytical process or the government’s policy priorities. In such a country, contracts would be awarded on the basis of personal connections rather than through an open competitive tendering process. Accountability would be nonexistent. It sounds like a dystopian scenario, but it's a reality in places where the rule of law is weak. Good public financial management (PFM) hinges on a robust legal framework that ensures transparency, fairness, and accountability. Without it, public resources are vulnerable to corruption, mismanagement, and ultimately, a breakdown of trust between citizens and their government.

What is the Rule of Law?

The rule of law, at its core, establishes a system where everyone, including those in charge of managing public resources, is subject to a clearly defined and consistently applied set of laws, regulations and norms. In the context of PFM, this translates to:

- Legal Frameworks: Clear and comprehensive laws that govern budget formulation, execution, and audit as well as procurement, taxation, and public debt.

- Independent Institutions: Administrations that operate autonomously from political influence to ensure fairness and accountability. According to (Gomez, 2016), an independent judiciary is important to ensure contract enforcement and protect property rights, which encourages business activity and economic growth.

- Transparency and Access to Information: Citizens have the right to access information about how public funds are being used. Transparency fosters trust and allows for public scrutiny of governmental decisions.

- Equal Application of Laws: Empirical research, such as that conducted by Gunel and Didinmez (2022), has demonstrated a clear link between a strong rule of law and positive fiscal outcomes, specifically showing that "the rule of law positively affects tax revenues in developed economies." This highlights how a stable legal environment encourages compliance and strengthens the government's ability to collect necessary tax revenues.

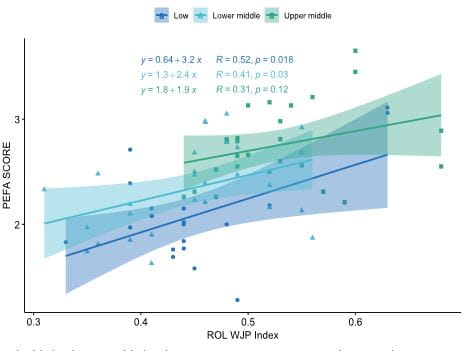

Figure 1: PEFA Scores versus WJP Rule of Law Index

The Rule of Law Can Be a Fiscal Catalyst: Evidence from PEFA

Our analysis reveals that there is a strong correlation between PEFA assessments scores and the rule of law level as measured by the World Justice Project Index. Specifically, countries with a stronger rule of law tend to exhibit higher aggregated PEFA scores. The effect appears particularly pronounced in low-income settings (R=0.52, p=0.018), where an 0.3 increase of the Rule of Law Index is associated with an improvement of one aggregated PEFA score (e.g., from 2,2 to 3.2). This is a very large increase because PEFA scores only range from zero to a maximum of 4.0. The implication is that the rule of law can be highly beneficial for improving PFM quality in low-capacity environments.

While a positive trend is also observed in upper-middle-income countries, the correlation is weaker and statistically less significant (R=0.31, p=0.12), where a 0.3 increase of the Rule of Law Index is associated with a 0.57 of aggregated PEFA scores. This indicates that other factors may play a more dominant role in influencing PFM quality at higher income levels.

Strengthening the rule of law in PFM requires a whole-of-society approach. This includes:

- Legislative Reforms: Updating and strengthening laws to address gaps and weaknesses and ensure effective enforcement.

- Capacity Building: Training public officials on PFM best practices and ethical conduct.

- Promoting Citizen Engagement: Encouraging public participation in budget processes through mechanisms like public hearings and budget consultations.

- Enhancing Judicial Independence: Ensuring that courts are free from political influence and able to enforce laws effectively.

- Technology for Transparency: Utilizing technology to enhance transparency and track public spending.

How to Implement Procedural Safeguards for Better PFM

The rule of law in public finance is only effective when it is embedded in precise, enforceable procedures that ensure transparency, accountability, and control over public spending. In France, the Règlement général sur la comptabilité publique (RGCP), then the Gestion budgétaire et comptable publique (GBCP) decree provide a formal framework separating the roles of authorizing officer and public accountant, while mandating internal financial controls and performance-based management.

Similar procedural safeguards exist in other contexts. In the UK, for example, the Managing Public Money guidance ensures financial propriety across departments. In the US, the Antideficiency Act prevents unauthorized expenditures. In developing countries formal regulations, such as those adopted in Kenya or Ghana also provide traceability and reduce corruption risks. These frameworks, rooted in international standards (e.g., the IMF Fiscal Transparency Code, Article 317 TFEU), demonstrate that legal formalism is not bureaucratic excess but the material condition for protecting public funds and upholding democratic accountability.

Conclusion

In conclusion, the rule of law is not merely a theoretical concept; it's the bedrock of sound PFM. Without it, budgets become vulnerable to abuse, and public resources are squandered. By upholding the rule of law, governments can build a foundation for fiscal integrity, promote sustainable development, and foster a society where public funds are used for the benefit of all. So, can budgets thrive without the rule of law? Absolutely not. The rule of law is not an option, it is a necessity.